This post explores the market trends driving this development—and what it means for colocation providers.

One of the data center trends Vertiv identified for 2018 was the increased reliance on colocation by cloud providers.

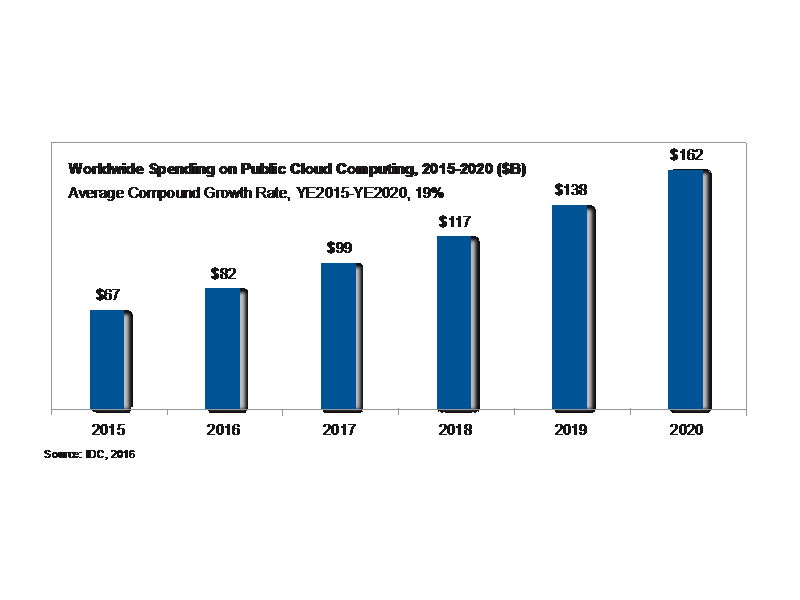

In 2016, IDC, projected a 19 percent compound growth rate for cloud computing between 2015 and 2020. That forecast now appears conservative. The analyst firm says the public cloud services market grew 28.6 percent in the first half of 2017, with revenues totaling $63.2 billion, a pace significantly higher than the projection of $99 billion for the full year.

Also, notable, Asia/Pacific saw the highest regional growth at 38.9 percent. It now represents 11.5 percent of all public cloud services revenues and is being driven by particularly strong growth in China, which saw 55.6 percent year-over-year growth in the first half of 2017.

Why Colocation Providers can better enhance your Data Center Network?

Cloud providers are dealing with two significant trends that put a strain on their ability to build out their data center networks: continued double-digit growth in demand and reduced tolerance for latency, which is driving services closer to users. As a result, they are, in many cases, choosing to focus on service delivery and other priorities over new data center builds. Colocation makes that possible.

By partnering with a colocation provider, they can be more responsive to shifts in demand and move services closer to users with greater capital efficiency than is possible by building out their own network. It also enhances operating flexibility. If demand doesn’t grow as expected, they can simply scale back their footprint without paying the price of low utilization. Finally, it takes complex decisions about data center location, in which access to large groups of users must be balanced with financial and reliability considerations, out of their hands.

In short, the business case for using colocation grows stronger as demand grows and users increasingly seek out low latency solutions.

Mitigating risks with Modular Data Centers

This represents a business opportunity for colocation providers, but colos must be prepared to assume the risk cloud providers are minimizing through the partnership. If demand doesn’t materialize as expected, it is the colo that will be left with an underutilized asset.

That’s one reason colos, like many in the industry, have adopted a modular approach to data center construction. Rather than large facilities with rigid multi-year plans that are often antiquated six months in, they are choosing to develop smaller facilities that can scale modularly as needs—and designs—change.

While this compromises some of the economies of scale available in large builds, this is often offset by a corresponding decrease in operating costs. Full utilization of the facility is achieved much faster, saving the colo from having to support unused capacity while the market develops or new customers are recruited and brought on board. Sound planning can also reduce costs of future expansion. For example, the potential may exist to leverage the redundancy in the first module to reduce infrastructure costs in the second.

Data Center Location and Capacity – critical factors when developing a facility

Colos are also continuing to expand their expertise in the area of site selection, negotiation and development. The ability to anticipate growth markets before they fully emerge and develop a foothold, is becoming a key differentiator for colocation providers. They understand they have to do more than demonstrate the ability to develop and operate data centers efficiently and reliably. They must be able to determine the right location for those data centers to meet capacity needs before they fully emerge and develop those facilities with an eye on an uncertain future.

In addition to planning for future capacity growth, potential changes in rack density need to be considered. Trends such as virtual reality, machine learning and autonomous vehicles may require higher density racks than the 10 kW design spec many colos currently build to. But, build for density too early and you have the same problem as building out capacity before demand exists: underutilized assets. Again, sound planning in the development stage can enable some rows within a facility to be converted to support high-density racks in the future without major overhauls to a facility.

What the future holds for Cloud Providers?

It seems likely that cloud providers will increasingly rely on colos to meet shifting capacity requirements, particularly in emerging markets. This represents a business opportunity for colos, but comes with risk. Colos could be left with underutilized assets if projections don't pan out or demand shifts in a way a particular data center can’t support. Colos can mitigate this risk by developing modular facilities that can be easily scaled in terms of both capacity and density.