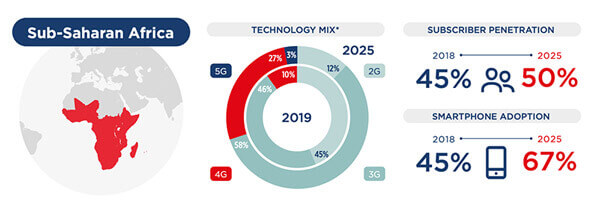

With current technology being primarily a mix of 2G and 3G, Africa still has strong potential to improve access and speed for the population, but does the need for 5G networks justify the investment? And what can governments do to ensure their countries reduce the barriers, enabling telecommunication (telco) companies to facilitate the progression to 5G technology?

5G will be a game changer for Africa and a big enabler for an increasingly digital economy. With the realization of greater efficiencies in complex operations, as well as the potential to drive enhanced growth and innovation on the continent, the transition to 5G is inevitable but must be approached with a degree of cautious optimism.

Market readiness in the region remains a key determinant for the transition to 5G technology, and while we have already seen the launch of commercially-ready 5G networks in Southern Africa, which is indeed indicative of that readiness, existing technologies remain capable of supporting current use cases and consumer demand for mobile internet connectivity.

3% OF SUB-SAHARAN AFRICA WILL BE 5G CONNECTED BY 2025

Figure 1. GSMA The Mobile Economy Report 2020

WHAT IS DRIVING THE DIGITAL ECONOMY IN AFRICA?

Africa is the fastest growing market in the world in mobile subscriptions and continues to be a pioneer in the FinTech space, especially around mobile-based financial solutions. With around half of the world’s mobile money providers operating in Sub-Saharan Africa alone, this remains one the key drivers of the digital economy. Mobile money has helped reduce the financial exclusion gap between the informal and formal sector across the continent, with the industry continuing to grow exponentially and projected to top US $14 billion in 2020.

Also driving the digital economy in Africa is internet usage, which continues to be on an upward trajectory, but is far from equitable with around 24% of the population of Sub-Saharan Africa with access. In large parts of the continent, there remains a need to extend access and coverage beyond urban centres to promote greater digital inclusion. Access disparities aside, however, Africa is also home to an altogether new generation of young, tech-savvy entrepreneurs and innovators actively using social media, with a strong need for high-speed internet connectivity, content, and data to conduct business. This group is spearheading digital transformation and growth on the continent and making the case for greater investment in 5G connectivity.

Africa remains the world’s last untapped data center market with major international players entering Africa to capitalize on the growth in demand for data predicted in the coming years.

South Africa continues to dominate the colocation data center market in Africa. Globally the MEA region accounts for only about 5% of the operational data center floorspace with Johannesburg still being Africa’s biggest colocation market. However in the last 24 months, there has been a dramatic surge in activity especially in West and East Africa.

WHAT DOES GROWTH IN DIGITAL MEAN FOR COLOCATION? MORE DATA CENTER INFRASTRUCTURE?

Africa continues to see high demand for mobile, online, and digital services, and this is being boosted as fibre rollouts continue to connect major urban centres. This evolution has fueled massive demand for local data centre infrastructure to support the increasing needs from African businesses undergoing digital transformation and pursuing colocation and cloud computing services as an integral part of that change. These opportunities have already attracted interest from major international players who have been deploying data centres across the continent.

The demand for digital services is also being met by undersea cables. Dare1 and METISS will bring an additional total of 84 terabytes (TB) via East Africa in 2020 alone. By 2023, the potential capacity from undersea cables will be 524 TB, more than doubling that of the last 10 years. This increase is largely due to cable projects such as Equiano by Google and 2Africa by a consortium of multinational corporations including Facebook, MTN, Vodafone, WIOCC and China Mobile which will contribute a combined 48,000 kilometres of cable around Africa corresponding to 280 TB.

Although demand for digital services is at a relatively early stage in markets other than South Africa, investment in this space is unlikely to slow down.

WHAT IS NEEDED FROM GOVERNMENTS TO SUPPORT DIGITAL ECONOMY GROWTH AND 5G NETWORKS?

The success of 5G network implementation on the continent in support of digital economic growth will naturally be reliant on the support of national governments and regulators. First and foremost, government buy-in from a value proposition standpoint is critical. It is important for national governments to understand the significance of 5G technology in promoting digital inclusion, the impact of 5G on industry in terms of making manufacturing more efficient, and the sustainability of 5G.

Secondly, licensing for the spectrum is perhaps one of the most important actions that should be undertaken to support 5G deployment. To encourage long-term heavy investments in 5G networks, governments should adopt national spectrum policy measures and frameworks. In collaboration with the private sector, governments can facilitate the evolution and security of 5G networks and incentivize network operators to build nationwide networks faster.

Africa is undergoing an unprecedented transformation, and evidently, there are hurdles to be overcome to make 5G on the continent viable in the long term. However, the strides that have been made in the last couple of years alone, paint a very optimistic picture of the future as 5G has arrived.